- The Rundown Tech

- Posts

- Biotech's big 3 (and they're wild)

Biotech's big 3 (and they're wild)

PLUS: Canada slashes tariffs on China's EVs

Good morning, tech enthusiasts. Things are getting wild in biotech — and fast. Gene editing is going bespoke, extinct species are getting a second act, and embryo screening now offers trait predictions for height and IQ.

MIT’s 2026 forecast lays out the trends reshaping biology, with startups outpacing regulators at every turn.

P.S. — The Rundown is hiring for several new roles across marketing, community, social, and more! Learn more and apply here.

In today’s tech rundown:

Biotech’s biggest 3 trends to watch

Canada opens doors to Chinese EVs

Threads overtakes X on mobile

TikTok’s answer to ReelShort is here

Quick hits on other tech news

LATEST DEVELOPMENTS

BIOTECH

Image source: Ideogram / The Rundown

The Rundown: Biotech is entering a new phase — one defined by customization, resurrection, and optimization. MIT Technology Review reports the biggest trends this year include personalized gene editing, species revival, and custom embryo screening.

The details:

A one-off “base-edited baby” case has become a template for custom gene therapies, using CRISPR tools to fix a child’s DNA for a rare metabolic disease.

Startups are racing to scale that model, pitching regulators on streamlined approvals for custom edits for rare-disease patients.

De-extinction companies like Colossal are now stitching genes from extinct species like the mammoths and dire wolves into living animals.

IVF clinics are rolling out embryo scoring that goes beyond disease risk to statistical bets on traits like height, eye color, and even IQ.

Why it matters: The science is thrilling — but decisions about who gets edited, which species return, and what traits get optimized are being made by startups and clinicians long before regulators weigh in. Biology’s new powers are testing the limits of the institutions meant to govern them. That tension is about to get loud.

EVS

Image source: Ideogram / The Rundown

The Rundown: Canada just slashed its 100% tariff on Chinese EVs to 6.1%, opening a new North American portal for BYD, Geely, and Xiaomi — and putting fresh pressure on the U.S. to respond.

The details:

Prime Minister Mark Carney announced the tariff cut alongside an initial cap of 49K vehicles annually, rising to about 70K within five years.

The move comes as the EU weighs lowering its own Chinese EV tariffs, and Trump said he’s open to Chinese automakers building U.S. factories.

Chinese EV exports to Mexico boomed in 2025, and Geely showcased vehicles at CES with executives hinting at a U.S. market entry within two to three years.

Tesla may be the first winner, with its Shanghai plant already configured to export Canadian-specific Model Ys and with 39 stores already operating there.

Why it matters: Canada just became a test market for Chinese EVs on America’s doorstep — giving U.S. consumers a front-row seat to the cars they can’t buy. If BYD and Geely start winning fans in Toronto and Vancouver, Washington’s 100% tariff wall might be a lot harder to justify.

THREADS

Image source: Reve / The Rundown

The Rundown: Meta’s Threads has overtaken Elon Musk’s X in daily mobile users worldwide, hitting 141.5M to X’s 125M — a significant milestone in the platforms’ rivalry that reflects months of steady gains rather than any single viral moment.

The details:

Threads crossed ahead of X on mobile sometime between late October and early November 2025, following a prolonged period of steady growth.

Market research firm Similarweb reports that Threads has grown 37.8% YOY on mobile, while X’s daily users dropped 11.9% in the same period.

X maintains a decisive lead when web usage is included, attracting an estimated 145.4M daily web visitors compared to some 8.5M for Threads.

While X still attracts more mobile users than Threads in the U.S., X’s U.S. daily active mobile user base has declined to about half of what it was a year earlier.

Why it matters: Threads’ mobile growth has been supported by Meta’s ability to funnel users from Instagram and Facebook, alongside a rapid expansion of features aimed at making the app stickier for daily use. X still leads overall, but Threads is winning on mobile, where most social media use happens.

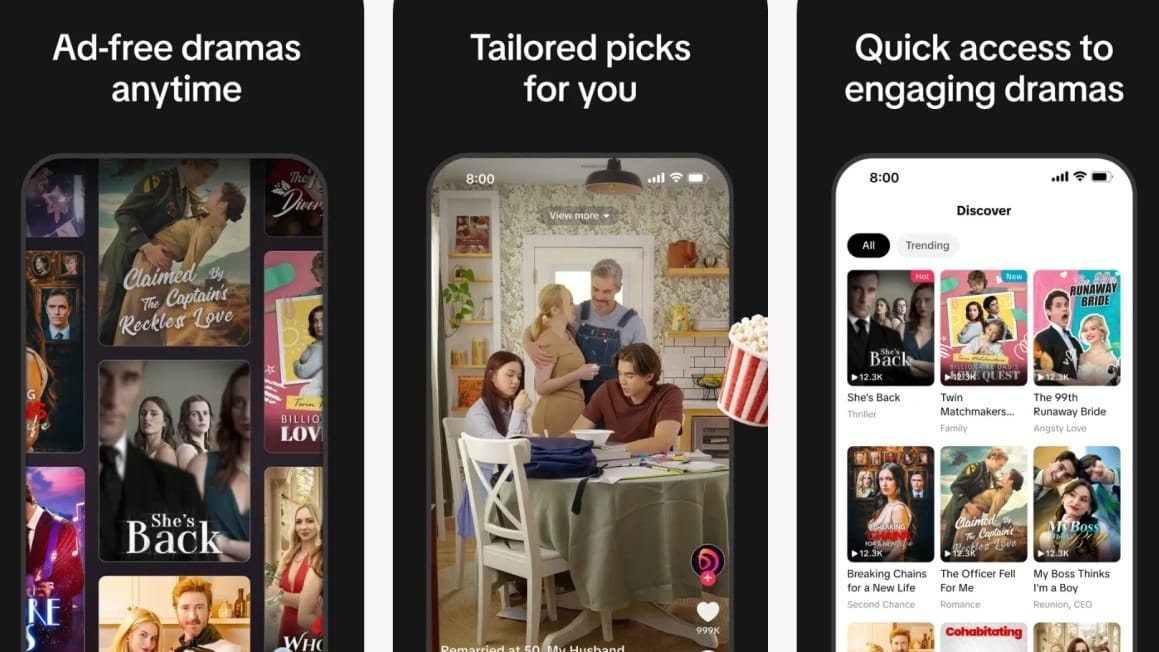

TIKTOK

Image source: TikTok

The Rundown: TikTok quietly launched PineDrama, a standalone app for binge-worthy one-minute drama episodes, directly challenging upstarts ReelShort and DramaBox in the fast-growing microdrama market.

The details:

The free, ad-free app is now available on iOS and Android in the U.S. and Brazil, serving up bite-sized fictional series across different genres.

PineDrama delivers vertical, algorithmically tailored recommendations —essentially TikTok’s addictive scroll mechanics applied to serialized storytelling.

The launch follows TikTok’s December rollout of “TikTok Minis,” an in-app microdrama section that tested the format before this dedicated spinoff.

The microdrama industry is projected to hit $26B in annual revenue by 2030, having cracked the formula that sank Jeffrey Katzenberg’s $1.75B Quibi.

Why it matters: TikTok already dominates short-form social video; PineDrama marks its push to own short-form entertainment content as well. If the company that perfected the infinite scroll can make serialized storytelling just as addictive, ReelShort and DramaBox may find themselves outplayed before they ever reach scale.

QUICK HITS

Elon Musk dropped $10M into a pro-Trump super PAC backing Kentucky Senate hopeful Nate Morris, signaling he’s all-in on boosting Republicans in the midterms.

Meta’s Oversight Board is reviewing a high-profile Instagram permanent ban for abusive and threatening content, its first-ever case on account disabling.

Global execs at this year’s Davos are reportedly less dazzled by AI hype and are zeroed in on the work of scaling it.

Elon Musk’s Boring Company is working on a feasibility study for a tunnel under I-80 to connect Reno to Tesla’s Gigafactory, nine miles away.

Sphere Entertainment is bringing a smaller, 6K-seat version of its Las Vegas venue to National Harbor, Maryland — its first expansion toward the DC market.

GSK is buying U.S.-based biotech firm Rapt Therapeutics for $2.2B to acquire its long-acting experimental food allergy drug ozureprubart.

U.S. safety regulators gave Tesla a five-week extension to respond to an investigation into whether its Full Self-Driving system is linked to traffic law violations.

Asus effectively hit pause on its smartphone business, with its chairman saying the company will stop making new Zenfone and ROG Phone models.

ClickHouse, an open-source database provider spun out of Yandex and a rival to Snowflake and Databricks, raised $400M at a $15B valuation.

A CoinGecko report found that over half of the 20.2M tokens launched since 2021 — most of them memecoins from 2025’s Pump.fun boom — have effectively died.

COMMUNITY

Read our last AI newsletter: Claude Code sparks 'selfware' era

Read our last Tech newsletter: Wikipedia inks deals with Amazon, Meta

Read our last Robotics newsletter: 1X now has a world model

Today’s AI tool guide: Optimize prompting with this Markdown strategy

RSVP to next workshop @ 4PM EST Friday: AI Foundations Bootcamp pt. 3

That's it for today's tech rundown!We'd love to hear your feedback on today's newsletter so we can continue to improve The Rundown experience for you. |

See you soon,

Rowan, Joey, Zach, Shubham, and Jennifer — The Rundown’s editorial team

Reply