- The Rundown Tech

- Posts

- The AI boom’s phone problem

The AI boom’s phone problem

PLUS: SpaceX IPO is Google's $111B windfall

Good morning, tech enthusiasts. Your next phone could get pricier— and AI is the reason.

A new forecast warns that the AI boom is gobbling up critical memory chips, setting the stage for supply crunches and sticker shock in 2026. As silicon gets swallowed by data centers, the cost squeeze looks to hit consumers right in their pockets.

In today’s tech rundown:

AI chip crunch may spike phone prices

SpaceX IPO could net Google $111B

Ford trades electric trucks for AI power

U.S. freezes $39B UK tech deal

Quick hits on other tech news

LATEST DEVELOPMENTS

AI BOOM

Image source: Ideogram / The Rundown

The Rundown: The AI boom is about to make your next phone more expensive. A new Counterpoint Research forecast warns that AI’s voracious appetite for memory chips will squeeze smartphone supply in 2026, pushing prices up by 6.9%.

The details:

Global smartphone shipments are expected to fall 2.1% in 2026, a sharp reversal from Counterpoint’s earlier prediction of stable or growing sales.

Average selling prices will jump 6.9% year-over-year — nearly double the firm’s previous 3.6% estimate — as shortages drive component costs up 15%.

Low-end phones under $200 have already seen material costs surge 20% to 30% since early 2025, with mid- and high-end devices up 15%.

Apple and Samsung are best positioned to absorb rising costs, while some Chinese brands may downgrade features or promote higher-priced models.

Why it matters: AI is now directly competing with consumer electronics for the same critical components, forcing smartphone makers to choose between shrinking margins and raising prices. The crunch hits budget and mid-tier Android phones hardest, potentially widening the gap between premium flagships and everything else.

SPACEX/GOOGLE

Image source: SpaceX

The Rundown: Alphabet’s red-hot streak could get even hotter if SpaceX goes public. Back in 2015, Google put about $900M into a 7% stake; at a rumored $1.5T IPO in 2026, that slice could be worth roughly $111B, reports Business Insider.

The details:

A SpaceX IPO at $1.5T would turn Google’s early stake into $111B — about 3% of Alphabet’s current value and possibly Silicon Valley’s best startup bet ever.

SpaceX has already boosted Alphabet’s results, contributing an estimated $8B gain — about 25% of its Q1 2025 net income.

Starlink operates on Google Cloud infrastructure, locking both companies into a strategic space-and-compute alliance.

Google ranks among SpaceX’s biggest outside backers, alongside VC firm Founders Fund and Fidelity.

Why it matters: What started as a controversial moonshot on Starlink has turned into both a financial and strategic coup. Starlink now powers connectivity for just about everyone, while SpaceX leans on Google Cloud on the back end, giving Alphabet a front‑row seat to one of the most important space plays of the decade.

FORD

Image source: Ford

The Rundown: Ford is killing its all-electric F-150 Lightning and pivoting unused battery capacity into a grid and data-center storage business. As it retreats from large EVs, the automaker is pouring billions into systems that feed AI infrastructure instead.

The details:

Ford canceled its next-gen all-electric truck (codenamed T3) and a commercial van, though the E-Transit survives. The F-150 Lightning dies entirely.

Instead of scrapping battery plans, Ford will launch an energy storage business using lithium iron phosphate systems for data centers and grid operators.

The company will invest roughly $2B over two years and target 20 GWh of annual storage capacity starting in 2027.

Ford will repurpose its Kentucky plant to build LFP cells, integrate them into storage modules, and package them as 20-foot DC container systems.

Why it matters: Ford’s retreat from electric pickups exposes Detroit’s recalibration: EV demand has stalled, political headwinds are mounting, and data centers offer better margins. Ford is chasing the same opportunity as Tesla and GM — after taking a reported $19.5B bruising on its EV business.

TECH POLICY

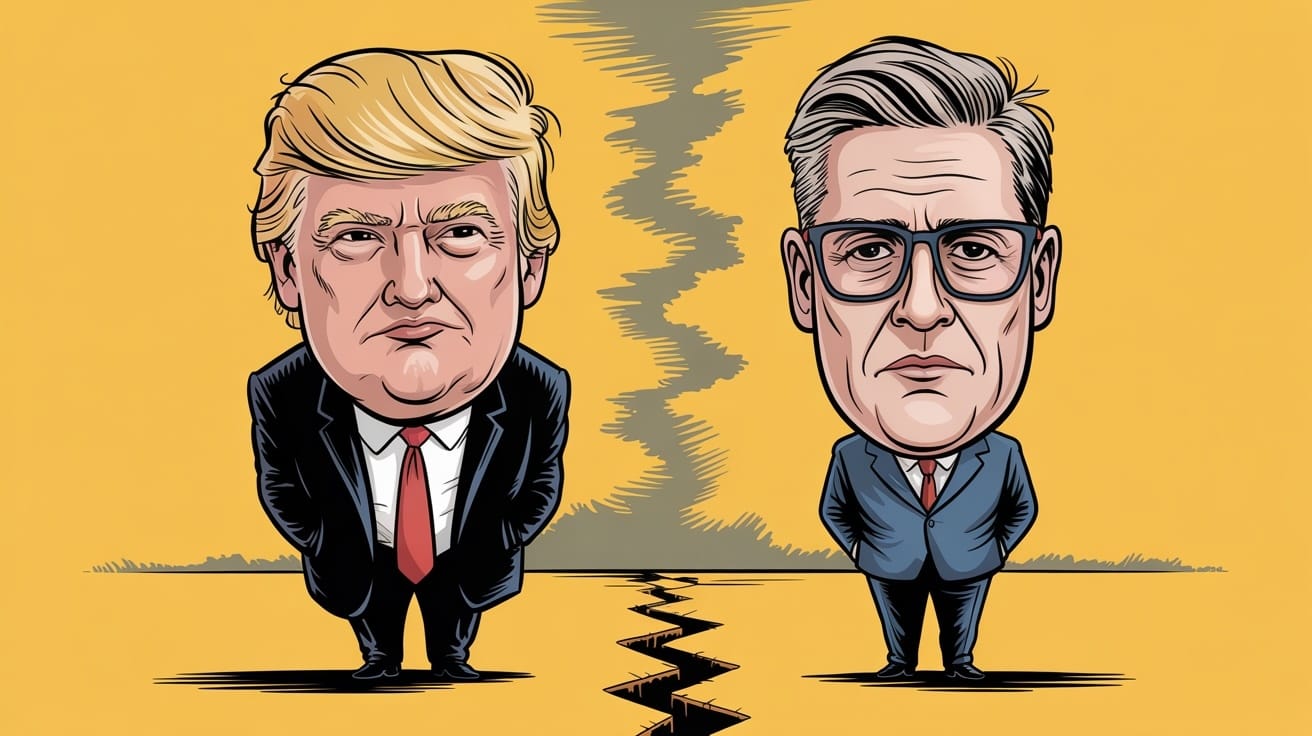

Image source: Ideogram / The Rundown

The Rundown: The U.S. has abruptly frozen negotiations on a “technology prosperity deal” with the UK, putting a high-profile tech pact announced during President Trump’s September state visit with UK Prime Minister Keir Starmer on indefinite hold.

The details:

The deal was positioned as a cornerstone of the renewed U.S.-UK “special relationship,” creating a transatlantic tech axis countering China’s influence.

Negotiations covered joint initiatives on AI, quantum computing, nuclear fusion, and other tech.

U.S. tech companies pledged billions in UK investments, including $27.5B from Microsoft and $6.3B from Google.

The Trump administration reportedly balked at the U.K.’s digital services tax on U.S. tech firms and food safety rules blocking certain U.S. agricultural exports.

Why it matters: The freeze is a setback for the UK government, which had positioned the deal as proof that a year of intensive diplomacy with Washington could shield British exports from Trump’s tariffs. It also exposes the fragility of tech diplomacy even between close allies: despite billions in corporate pledges and shared strategic goals.

QUICK HITS

Netflix co-CEOs moved to calm staff over the company’s bid for Warner Bros. Discovery, stressing that there’s little business overlap and no plans to shutter studios.

Google is shutting down its dark web monitoring feature, telling users it will stop scanning for exposed personal data on January 15.

Merriam-Webster named ‘slop’ as its 2025 Word of the Year, defined as “digital content of low quality that is produced usually in quantity by means of AI.”

The U.S. government has launched “Tech Force,” a new initiative to hire 1K early‑career AI and software specialists into federal jobs to boost tech talent.

Overview Energy has raised $20M to pursue space-based solar, using satellites to beam power down to Earth-side solar panels for round-the-clock clean electricity.

Tesla shares reportedly closed at a new high for 2025 after Elon Musk told investors the company has begun testing fully driverless robotaxis on public roads in Austin.

Colin Angle, co-founder and former CEO of Roomba-maker iRobot, called the company’s bankruptcy “nothing short of a tragedy for consumers.”

Lightspeed Venture Partners, the 25-year-old VC firm, just closed a record $9B in new funds, marking the biggest capital raise in its history.

COMMUNITY

Read our last AI newsletter: Nvidia's powerful open AI model play

Read our last Tech newsletter: SpaceX preps monster $1.5T IPO

Read our last Robotics newsletter: 1X’s home humanoid gets a factory job

Today’s AI tool guide: Design websites with Cursor’s visual design editor

Watch our last live workshop: AI Automations Made Simple

That's it for today's tech rundown!We'd love to hear your feedback on today's newsletter so we can continue to improve The Rundown experience for you. |

See you soon,

Rowan, Jennifer, and Joey—The Rundown’s editorial team

Reply